Arich Lawson | Good pictures

Yesterday, Microsoft declared Xbox hardware sales in the first quarter of 2024 (ending March) were down 31 percent from a year earlier, which it says was “driven by lower volumes of consoles sold.” Not because the console sold better a year ago; Xbox hardware revenue for the first calendar quarter of 2023 Already down 30 percent from previous year.

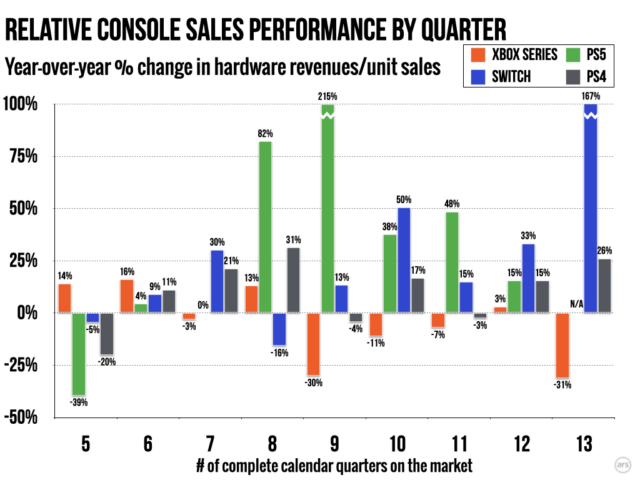

Both of those data points speak for a console that, historically, should be in its strongest sales period. But since Microsoft reports its Xbox sales numbers (ie, only based on quarterly changes in total console hardware revenue), it's a bit difficult to get broader context on those numbers. It's not easy to compare those annual changes to the unit sales numbers that Nintendo and Sony report each quarter.

Context clues

Kyle Orland

To attempt some direct situational comparisons, we took the unit sales numbers for some of the most recent successful Sony and Nintendo consoles and converted them to Microsoft-style year-over-year percentage changes (aligned with the release date for each console). For this analysis, we excluded each console's launch quarter, which had less than three months of total sales (and often included early adoption demand). We've also excluded the first four quarters of a console's lifecycle, which doesn't have a year-over-year comparison point of 12 months.

It's still not a fair comparison. Inflation, residual sales of Xbox One hardware, and price cuts/discounts (although the Xbox Series S/X, PS5, and Switch have yet to see official price drops, unit sales do not directly account for total hardware revenue. ) This does not take into account base sales volume from each console's first year of sales. , making total lifetime sales performance difficult to measure on the Xbox side (although Latest data from Take-Two Investment Call Xbox Series S/X claims to be outsold by PS5 at this point).

Even with all those caveats, the comparative data trends are pretty clear. Entering their fourth full year on the market, the latest hit consoles are enjoying a general uptick in year-over-year sales. Microsoft stands out as a big spender, reporting lower revenue from Xbox hardware on a year-over-year basis in four of the past five quarters.

Arich Lawson

Those numbers suggest that hardware sales for the Xbox Series S/X may have already peaked in the past year or two. It would be historically premature for this type of console; Previous Ars analyzes have shown that PlayStation consoles typically reach sales peaks in their fourth or fifth year, and Nintendo portables have historically shown a similar sales trend. The Xbox Series S/X progress, on the other hand, looks a lot like the Wii U, which was already deep in a “death spiral” at a similar point in its commercial life.

This is not the end

In the past, console sales trends like these would have been indicative of a hardware maker's broader struggles to stay afloat in the gaming business. However, in today's gaming market, Microsoft is in a position where console sales aren't strictly necessary for overall success.

For example, Microsoft's total gaming revenue rose 51 percent in the most recently reported quarter, thanks in large part to the “net impact of the Activision Blizzard acquisition.” Even before the (expensive) merger ended, Microsoft's total gaming revenue was often higher Partly encouraged by “development in Game Pass”. and strong “software content” sales on PC and other platforms.

Activision

It's no surprise that Microsoft has shown more interest in porting some former Xbox console exclusives to other platforms in recent months. Indeed, following the Activision/Blizzard merger, Microsoft is now releasing more vendors on the PS5 than Sony. Microsoft should not forget the PC market Continues to sell millions of games Above and beyond its PC Game Pass subscription business.

So, while the business future of Xbox hardware seems a bit uncertain, the future of Microsoft's gaming business as a whole is in dire straits. That's true even though Microsoft's Xbox hardware revenue is down 100 percent.